Ethiopia inaugurates the $5B Grand Renaissance Dam, Africa’s largest hydropower project, delivering 5,150 MW capacity while sparking regional disputes over Blue Nile water flows.

Source: New feed

Ethiopia inaugurates the $5B Grand Renaissance Dam, Africa’s largest hydropower project, delivering 5,150 MW capacity while sparking regional disputes over Blue Nile water flows.

Source: New feed

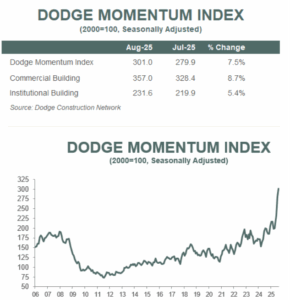

Elevated activity pushes index to new peak

BOSTON, MA – September 8, 2025 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 7.5% in August to 301.4 (2000=100) from the downwardly revised July reading of 279.9. Over the month, commercial planning expanded 8.7% while institutional planning grew 5.4%. Year-to-date, the DMI is up 30% from the average reading over the same period in 2024.

“The DMI continues to point to stronger construction activity in late 2026 or early 2027 within specific sectors,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “Because this Index uses a three-month moving average, last month’s strong activity sustained this month’s positive gains despite a pullback in the raw, unadjusted data. Following months of uncertainty caused by tariff concerns, owners and developers have started progressing with projects while accepting higher costs. Given the persistent economic and fiscal uncertainty, volatility in planning activity will remain high.”

On the commercial side, all sectors sustained momentum over the month – notably led by strength in data centers, warehouses and hotels. Parking garages & service stations also experienced steady gains. On the institutional side, education and healthcare planning decelerated from last month’s growth but remained positive. A slew of detention facility and court building projects also drove lofty gains in the public building sector throughout August. In August, the DMI was up 51% when compared to year-ago levels. The commercial segment was up 38% from August 2024 and the institutional segment was up 84% over the same period. If all data center projects between 2023 and 2025 are excluded, commercial planning would still be up 38% from year-ago levels driven by an uptick in warehouse and automotive planning.

A total of 51 projects valued at $100 million or more entered planning throughout August. The largest commercial projects included the $500 million Big Sky Data Center Campus and Battery Storage (500 MW) in Billings, Montana, the $360 million Prologis Concorde data center in Sterling, Virginia and the $347 million Johnston County Government Complex in Smithfield, North Carolina. The largest institutional projects to enter planning were the $490 million Weld County Judicial Center in Greeley, Colorado, the $375 million dormitory within the Medical Education Training Complex in San Antonio, Texas and the $360 million renovation to the Framingham Correctional Institution in Framingham, Massachusetts.

The DMI is a monthly measure based on the three-month moving value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year to 18 months.

The post Dodge Momentum Index Grows 8% in August appeared first on Dodge Construction Network.

Source: New feed

Metro Vancouver’s regional water utility is nearing completion of its $288M Annacis Water Tunnel under the Fraser River, part of a $2B seismic-resilient water program.

Source: New feed

The latest Bureau of Labor Statistics report found construction lost 7,000 positions in August, the industry’s third straight month of job declines.

Source: New feed

US appeals court majority said Florida Everglades facility wont have to dismantle while opponents’ legal case continues, challenging lower court on whether it is subject to federal environmental protection rules

Source: New feed

ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

With artificial intelligence, autonomous vehicles and other technologies coming of age, mobility is at a “transformative” stage worldwide, experts said at the Atlanta event.

Source: New feed

The 2025 Project of the Year—and all of this year’s winning projects—will be recognized at ENR Southeast’s Best Projects event on Oct. 23 in Orlando.

Source: New feed

Economic uncertainty and rising prices lead to declining construction activity in July, the third consecutive month nonresidential construction spending has fallen.

Source: New feed

Boston startup company founded by two women engineers is designing personal protective equipment just for women in construction and other high-risk fields.

Source: New feed