ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

City will investigate the partial collapse of the concrete bridge structure built between 1967 and 1971,.

Source: New feed

Officials pledge to investigate the partial collapse of the concrete bridge structure.

Source: New feed

The 39-hour continuous installation of the 42-in. HDPE pipe is part of the larger Hampton Roads Sanitation District’s Boat Harbor Treatment Plant Conversion and Transmission program.

Source: New feed

It isn’t an exaggeration to say that Nadine M. Post is the top journalist on building design and construction and related topics. Her retirement after a 46-year association with ENR leaves a gap impossible to fill.

Source: New feed

ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

Advanced Construction Robotics, maker of TyBOT, has announced that it is now offering its rebar-tying robot through direct sales rather than an just ongoing service arrangements.

Source: New feed

Planning momentum is gaining traction across several sectors ahead of rate cuts

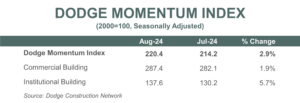

BEDFORD, M.A. – September 9, 2024 — The Dodge Momentum Index (DMI), issued by Dodge Construction Network, increased 2.9% in August to 220.4 (2000=100) from the revised July reading of 214.2. Over the month, commercial planning expanded 1.9% and institutional planning improved 5.7%.

“Owners and developers continued to prime the planning queue in August, ahead of next year’s anticipated stronger market conditions,” stated Sarah Martin, associate director of forecasting at Dodge Construction Network. “With the Fed’s September rate cut all but finalized, the influence of selective lending standards and inflation should moderate next year, alongside a modest upgrade to consumer demand. As a result, stronger planning activity was widespread in August, with most nonresidential sectors seeing growth.”

Commercial planning saw another month of broad-based improvements. After slowing down in recent years, warehouse projects have gained momentum over the last three months. Hotels and retail planning have been steadily expanding as well. Data centers continued to dominate large project activity, but the rate at which planning projects entered the queue in August moderated after several months of very strong growth. On the institutional side, healthcare was the primary driver of this past month’s expansion, followed by recreational planning. In August, the DMI was 31% higher than in August of 2023. The commercial segment was up 42% from year-ago levels, while the institutional segment was up 8% over the same period.

A total of 30 projects valued at $100 million or more entered planning throughout August. The largest commercial projects included the $500 million portion of the Tract Data Center Complex in Yuma, Arizona, and the $462 million KDC Data Center Campus in Irving, Texas. The largest institutional projects to enter planning were the $440 million Geisinger Medical Center Tower in Danville, Pennsylvania and the $240 million academic and research facility at the University of Cincinnati in Ohio.

The DMI is a monthly measure of the value of nonresidential building projects going into planning, shown to lead construction spending for nonresidential buildings by a full year.

The post Dodge Momentum Index Rises 3% in August appeared first on Dodge Construction Network.

Source: New feed

The largest award in this round is $55.1 million to Tucson International Airport to shift or reconfigure a runway.

Source: New feed

Bentley Systems acquired on Sept. 6 geographic information and 3D Tiles provider Cesium, with terms not disclosed for the deal set to close by the end of 2024.

Source: New feed