A lack of megaprojects normalized activity.

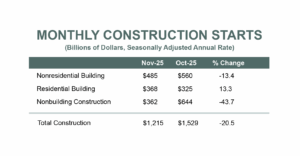

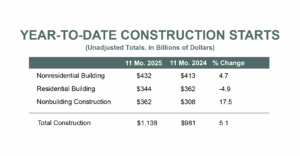

BOSTON, MA — December 22, 2025 — Total construction starts were down 20.5% in November to a seasonally adjusted annual rate of $1.22 trillion, according to Dodge Construction Network. Nonresidential building starts fell by 13.4%, residential starts increased 13.3%, and nonbuilding starts dropped 43.7% over the month. On a year-to-date basis through November, total construction starts were up 5.1% from last year. Nonresidential starts were up 4.7%, residential starts were down 4.9% and nonbuilding starts were 17.5% higher over the same period. For the 12 months ending November 2025, total construction starts were up 5.7% from the 12 months ending November 2024. Residential starts were down 3.6%, nonresidential starts grew 4.8%, and nonbuilding starts were up 18.0% over the same period.

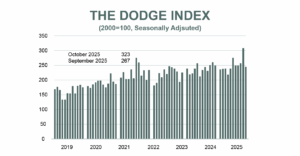

“A lack of megaproject activity contributed to a weak November for construction starts,” stated Eric Gaus, Chief Economist at Dodge Construction Network. “There were only 2 structures over a billion dollars. Looking through the noise of the last two months, the trajectory of the last half of 2025 has been much better than the first half.”

Residential

Residential building starts rose by 13.3% in November to a seasonally adjusted annual rate of $368 billion. Single family starts increased 3.1%, while multifamily starts jumped 35.6%. On a year-to-date basis through November, residential starts are down 4.9% – with single family starts down 12.8% and multifamily starts up 12.4%.

For the 12 months ending November 2025, total residential starts fell 3.6%. Single family starts fell 11.2% compared to the 12 months ending November 2024, and multifamily starts increased 12.4% over the same period.

The largest multifamily structures to break ground in November were the $391 million Residential Mixed Use, in Seattle, WA, the $228 million Marine Drive Apartments/Parking – Phase 1 in Buffalo, NY and the $224 million Namdar Mixed-Use Residential-Swimming Pool-Parking Phase 2 in Miami, FL.

Nonresidential

Nonresidential building starts decreased 13.4% in November to a seasonally adjusted annual rate of $485 billion. Commercial starts were down 25.8%, alongside declines in offices and data centers (-40.5% m/m) and hotels (-33.2% m/m). Meanwhile, parking garages (30.5% m/m), retail stores (8.3% m/m) and warehouses (6.4% m/m) posted growth between October and November. Institutional starts improved 11.4%, driven by gains in public (+78.8% m/m) and education buildings (+32.1% m/m) – but offset by declines in amusement (-51.1.8% m/m) and dormitories (-45.9% m/m). Manufacturing activity remains volatile, falling 50.7% in November. On a year-to-date basis through November, nonresidential starts are up 4.7% compared to the first eleven months of 2024. Commercial and industrial starts are up 11.6% and institutional starts are down 2.0% over the same period.

For the 12 months ending November 2025, total nonresidential starts were up 4.8% compared to the 12 months ending November 2024. Commercial starts were up 19.9%, institutional starts declined 1.5%, and manufacturing starts were down 13.7% over the same period.

The largest nonresidential building projects to break ground in November were the $1.8 LAX Terminal 5 Renovation & Reconstruction in Los Angeles, CA., the $800 million Amazon – Southern Site – Data Center in Olive Township, IN, and the $797 million New UCSF Benioff Children’s Hospital Campus in Oakland, CA.

Nonbuilding

Nonbuilding construction starts declined 43.7% in November to a seasonally adjusted annual rate of $362 billion. Miscellaneous nonbuilding (-70.4% m/m) drove the declines, along with utilities (-61.4 m/m) and Highway and bridges (-4.9%). Environmental public works starts rose by 6.8% over the month. On a year-to-date basis through November, nonbuilding starts were up 17.5%, alongside gains in miscellaneous nonbuilding (+42.6% m/m), utilities (+49.5%), highways and bridges (+1.7%) while environmental public works declined 1.4%.

For the 12 months ending November 2025, total nonbuilding starts were up 18.0%. Environmental public works improved by 2.0% compared to the 12 months ending November 2024. Highway and bridge starts were up 2.1%, miscellaneous nonbuilding starts were up 40.6% and utility/gas starts increased 47.8% over the same period.

The largest nonbuilding projects to break ground in November included the $1.7 billion Entergy Meta Substations – 500kv Line (Sarepta to Mt Olive) in Rayville, LA the $922 million Easley Renewable Energy Solar Array 400MW/650MW BESS in Dester Center, CA and the $900 million The New Castle Bluff Energy Center Natural Gas Power Plant in St Louis, MO.

Regionally, total construction starts in November rose in the Northeast (+17.9%), and the West (+3.7% m/m). Starts declined in the South Central (-49.2% m/m), Midwest (-7.7% m/m), and the South Atlantic (-8.4% m/m) between October and November.

The post Construction Starts pull back 20.5% in November appeared first on Dodge Construction Network.

Source: New feed