Tightening economic conditions contribute to Commercial and Multifamily Starts Losing Ground

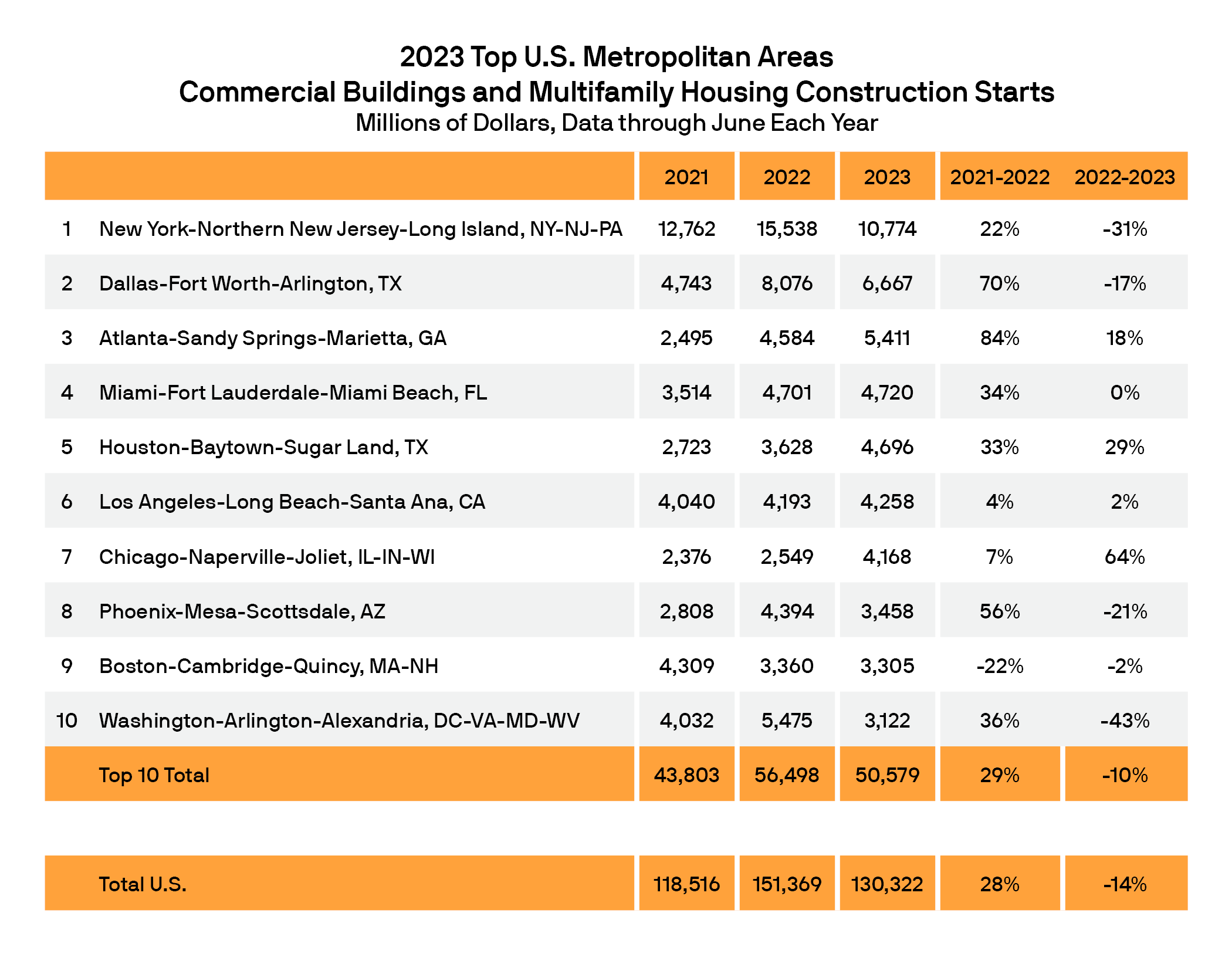

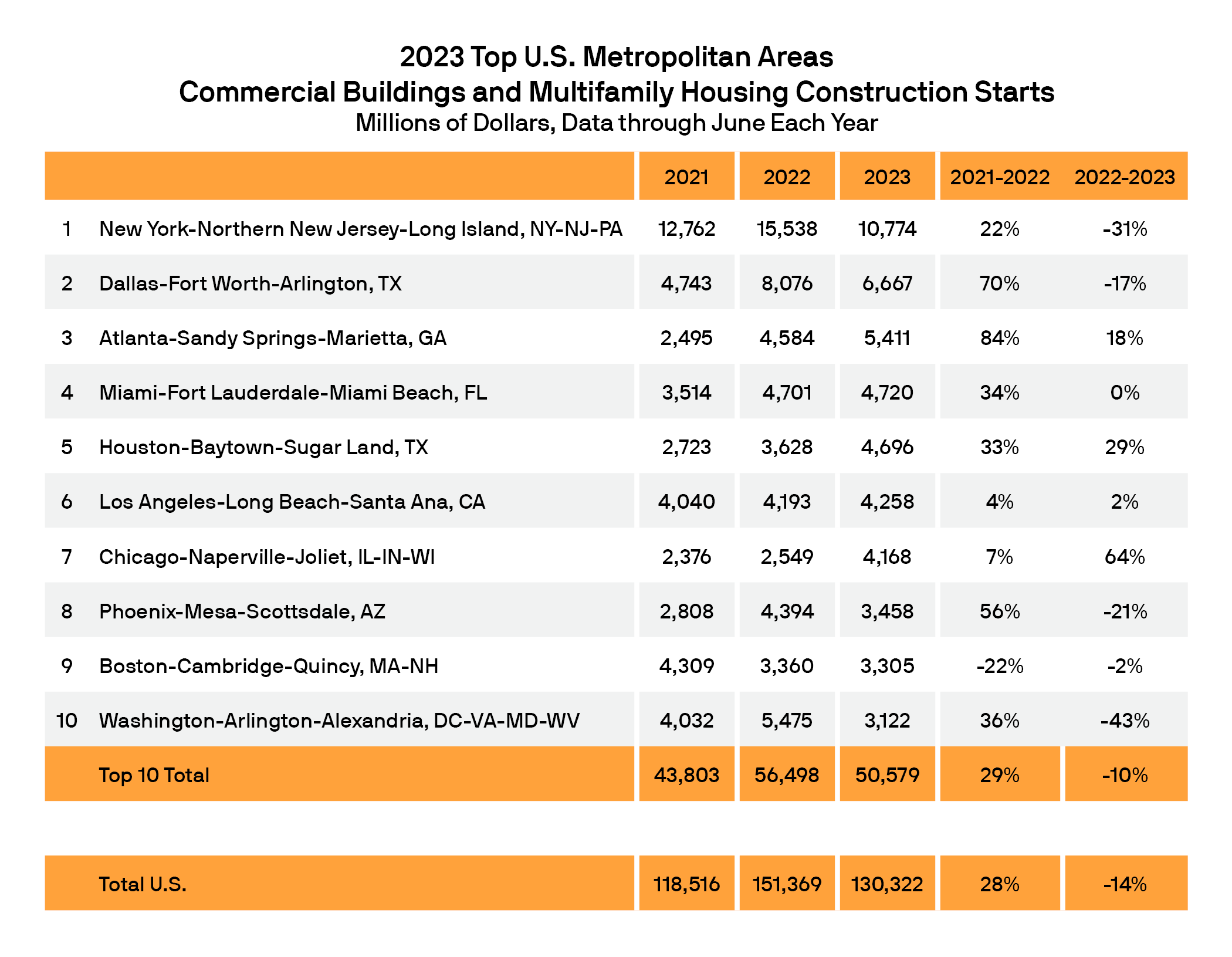

HAMILTON, New Jersey — July 26, 2023 — New data from Dodge Construction Network found that the value of commercial and multifamily construction starts across the top 10 metropolitan areas of the U.S. fell 10% in the first half of 2023, relative to that of 2022. Nationally, commercial and multifamily construction starts fell 14% on a year-to-date basis through June.

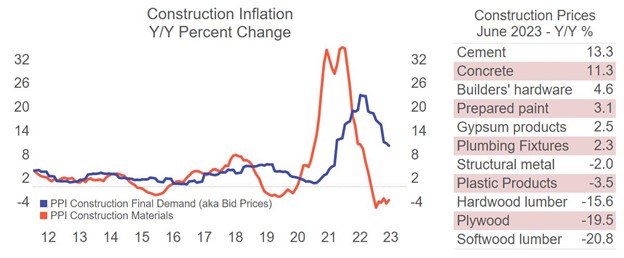

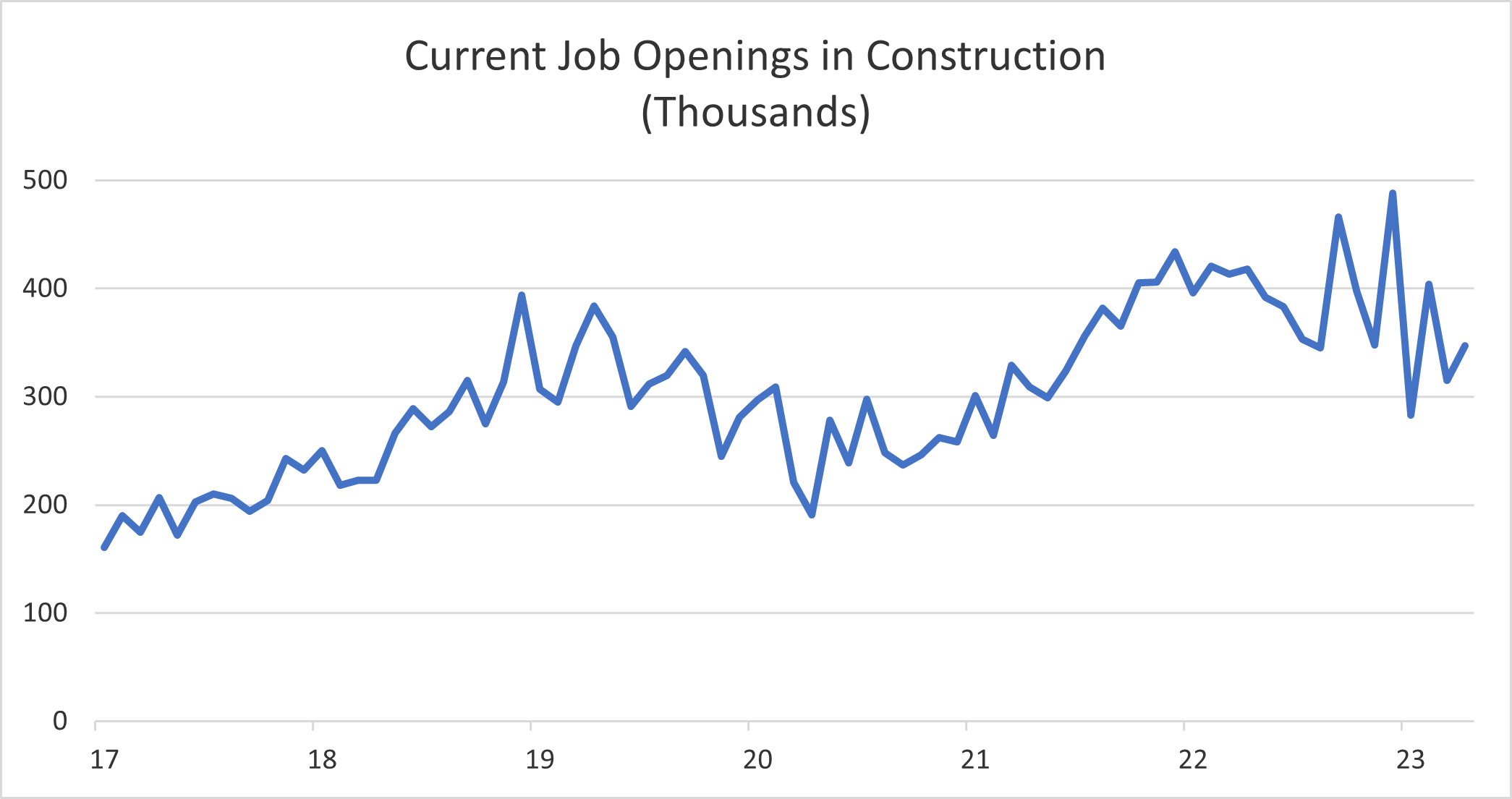

Commercial and multifamily construction has suffered thus far into 2023 as tighter lending standards, higher interest rates, slowing demand and societal changes, such as continued remote work, impact the sector.

In the first half of 2023, the New York metropolitan area was the top market for commercial and multifamily starts at $10.8 billion, a 31% decrease from the first six months of 2022. In second was the Dallas, Texas, metropolitan area, totaling $6.7 billion in the first half of 2023, a 17% decline. The Atlanta, Georgia, metro area ranked third with $5.4 billion in starts — an 18% gain over 2022 on a year-to-date basis.

The remaining top 10 metropolitan areas through the first half of 2023 were:

- Miami, Florida, flat ($4.7 billion)

- Houston, Texas, up 29% ($4.7 billion)

- Los Angeles, California up 2% ($4.3 billion)

- Chicago, Illinois up 64% ($4.2 billion)

- Phoenix, Arizona, down 21% ($3.5 billion)

- Boston, Massachusetts, down 2% ($3.3 billion)

- Washington, D.C., down 43% to ($3.1 billion).

The top 10 metropolitan areas accounted for 39% of all commercial and multifamily starts in the United States in the first half of 2023, up from 37% in that of 2022.

Commercial and multifamily starts are comprised of office buildings, stores, hotels, warehouses, commercial garages and multifamily housing. Not included in this ranking are institutional projects (e.g., educational facilities, hospitals, convention centers, casinos, transportation terminals), manufacturing buildings, single family housing, public works and electric utilities/gas plants.

In total, U.S. commercial and multifamily building starts fell 14% to $130 billion on a year-to-date basis through six months. Multifamily starts lost 17%, declining to $61 billion, and commercial starts fell 11% to $70 billion. In the first half of 2023, across the top 10 metro areas, commercial building starts rose 1% to $27 billion, while multifamily starts fell 21% to $24 billion.

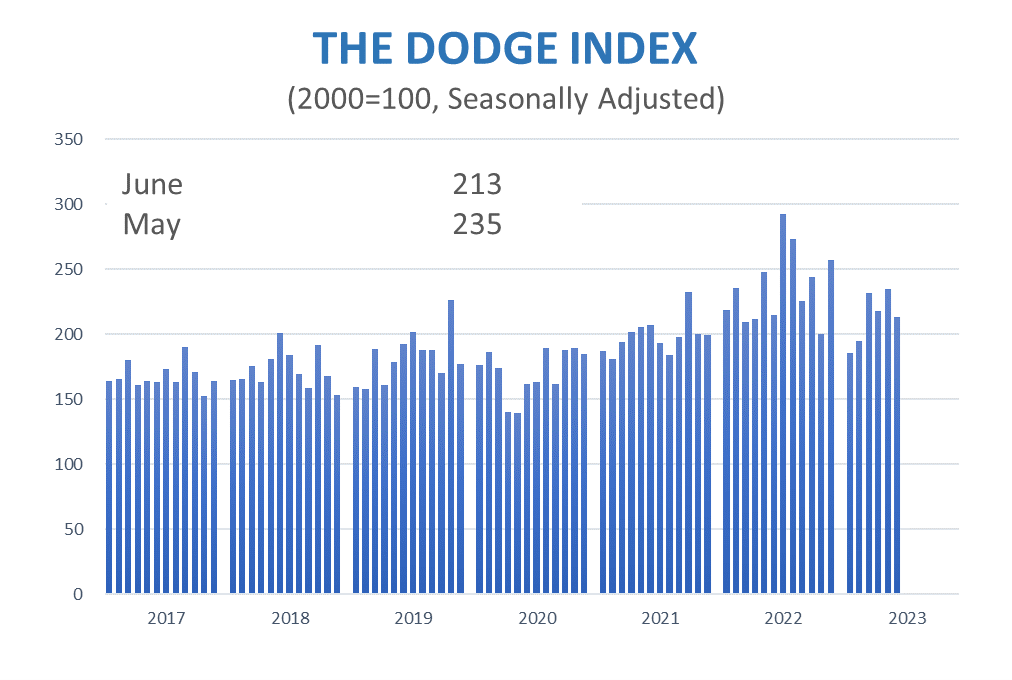

“The wind has gone out of the sails for the commercial and multifamily sectors,”

stated Richard Branch, chief economist for Dodge Construction Network. “Starts are likely to worsen still in the second half of the year, as interest rates head even higher. Tighter financial conditions and significant market shifts have led to precipitous declines in starts across many metropolitan areas. However, even as markets begin to recover next year, significant structural change in the sector could lead to a tepid recovery with levels well below what was seen before the pandemic.”

In the New York metropolitan area, commercial and multifamily construction starts fell 31% in the first six months of 2023 to $10.8 billion. Multifamily starts were down 39% following a robust first half of last year., with the largest multifamily projects to break ground being the $500 million 7112 Park Ave project and the $414 million North Cove mixed-use building. At the same time, commercial starts fell 11% due to a pullback in parking structures and retail, offsetting gains in hotel, warehouse and office construction. The largest commercial projects to get started in the first half of 2023 were the $100 million Rolex headquarters and the $94 million College Point Logistics Center.

Commercial and multifamily starts in the Dallas, Texas, metro area were down 17% to $6.7 billion on a year-to-date basis through June. Commercial starts fell 17%, despite gains in office and retail structures. The largest commercial projects to get underway during the first half of the year were the $154 million Aligned data center and the $119 million Google data center. Multifamily starts were down 18%, with largest multifamily project starts being the $268 million Knox mixed-use building and the $118 million first phase of the Alexan Frisco Brinkman Ranch apartments.

In the Atlanta, Georgia, metropolitan area, commercial and multifamily construction starts rose 18% to $5.4 billion during the first half of 2023. On a year-to-date basis, multifamily starts were down 23% from the first half of 2022. The largest multifamily projects to break ground during the first six months of the year were the $500 million 1072 W Peachtree mixed-use building and the $245 million 1077 Juniper Apartments. In the first six months of 2023, commercial starts rose 61% from the first six months of 2022, with all categories but retail posting gains. The largest commercial projects to get underway during the year were the $642 million first phase of the Facebook Stanton Springs data center and a $171 million data center.

Miami, Florida, commercial and multifamily starts during the first half of 2023 were on par with that of 2022 at $4.7 billion. Commercial starts in Miami gained 4% on a year-to-date basis through June due to a large increase in warehouse starts amid declines across all other sectors. The largest commercial projects to get started during the first half of 2023 were a $61 million warehouse and the $46 million Gaumard Scientific building. In the first half of 2023, multifamily starts fell 1% compared to that of 2022. The largest multifamily projects to get started through June 2023 were the $164 million second phase of the Baccarat Residences and the $160 million first phase of the Namdar mixed-use building.

The Houston, Texas, commercial and multifamily building starts rose 29% on a year-to-date basis through June to $4.7 billion. Commercial starts in Houston gained 24% in the first six months of the year with all categories posting healthy growth. The largest commercial projects to start during the first half of the year were the $77 million Port 99 warehouse and the $50 million FreezPak cold storage building. Multifamily starts meanwhile rose 40% in the first half of the year. The largest multifamily buildings to break ground in the first six months of 2023 were the $200 million DeisoMoss mixed-use building and the $99 million Residences on Westheimer.

Together, commercial and multifamily starts in the Los Angeles, California, metropolitan area grew 2% to $4.2 billion during the first half of 2023. During the first half of the year, multifamily construction fell 12%. The largest multifamily structures to break ground during the first half of 2023 were the $385 million 710 Broadway mixed-use building and the $150 million Ritz Carlton VEA Newport Beach. In the first six months of 2023, commercial starts moved 33% higher than the first six months of 2022, with all commercial categories posting an increase. The largest commercial projects to get started during the first half of the year were the $490 million JMB Century City Center office building and the $70 million 6381 Hollywood Blvd office building.

In Chicago, Illinois, commercial and multifamily starts were up 64% on a year-to-date basis through June 2023 to $4.2 billion. Multifamily starts were up 53%, through the first six months of 2023. The largest multifamily projects to break ground being the $190 million Albany Terrace and Irene McCoy Gaines apartment alteration project and the $140 million 1114 W Carroll Ave apartment building. In the first six months of 2023, total commercial starts rose 71% compared to the first six months of 2022. The gain was the result of a large increase in office starts, although hotel and retail construction also rose. The largest commercial projects to get underway during the first half of the year were the $1 billion Prime data center campus and the $330 million 917 W Fulton Market office building.

Phoenix, Arizona, commercial and multifamily starts during the first six months of 2023 were down 21% to $3.5 billion from the first half of 2022. Commercial starts in Phoenix fell 20% on a year-to-date basis through June with only office and retail increasing. The largest commercial projects to start during the first six months of 2023 were the $150 million QTS McDowell data center and the $100 million Prologis Commerce Park Building #3 warehouse. In the first half of 2023, multifamily construction fell 24% from the first six months of 2022. The largest multifamily buildings to get started were the $100 million Portico condos and the $88 million RD Kirkland apartments.

Boston, Massachusetts, commercial and multifamily construction starts dropped 2% to $3.3 billion during the first half of 2023. Commercial starts moved 5% higher on a year-to-date basis through June due to an increase in office and parking construction. The largest commercial projects to break ground during the first six months of 2023 were the $228 million Landmark Center/401 Park office building and the $130 million Reservoir Woods East office building. Multifamily starts fell 7% on a year-to-date basis through June 2023. The largest multifamily structures to break ground so far this year were the $175 million third phase of the 135 Broadway/MXD residential building and the $132 million 1690 Revere Beach Parkway residential building.

In Washington, D.C., commercial and multifamily starts in the first half of 2023 were down 43% from the first half of 2022 to $3.1 billion. Multifamily starts lost 45% on a year-to-date basis through June. The largest multifamily projects to get underway during the first half of the year were the $215 million Four Season condo building and the $100 million Residences at Forest Glen. Commercial starts were down 42% during the first six months of 2023, with warehouse being the only category to post a gain. The largest commercial projects to break ground during the first half of the year were the $500 million Smithsonian South Campus Castle renovation and the $157 million first phase of the NVAL3 data center.

The post Commercial and Multifamily Starts Declined in 5 of the Top 10 Metro Areas in the First Half of 2023 appeared first on Dodge Construction Network.

Source: New feed