Japan auto giant’s new EV battery plant will be the third in Ontario—in addition to a Volkswagen facility in St. Thomas to start construction in 2025 and a Stellantis-LG plant in Windsor under way since last year.

Source: New feed

Japan auto giant’s new EV battery plant will be the third in Ontario—in addition to a Volkswagen facility in St. Thomas to start construction in 2025 and a Stellantis-LG plant in Windsor under way since last year.

Source: New feed

Japan auto giant’s EV battery plant will be the third in Ontario—in addition to a Volkswagen facility in St. Thomas to start construction in 2025 and a Stellantis-LG plant in Windsor under way since last year.

Source: New feed

The funding agreement with the U.S. Commerce Dept. was contingent on Micron Technologies’ recently announced pledge to invest $50 billion in the plants over the next five years.

Source: New feed

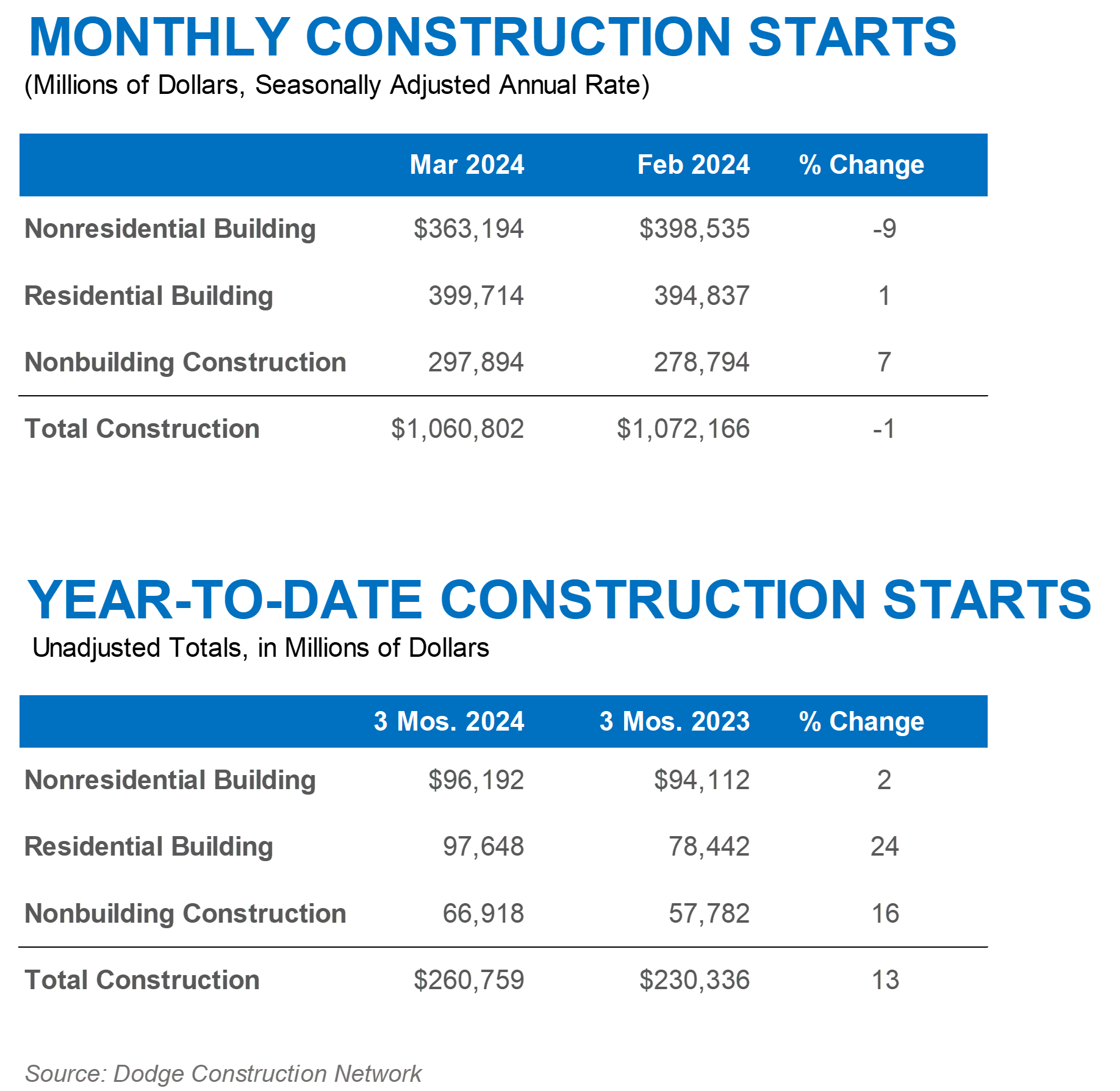

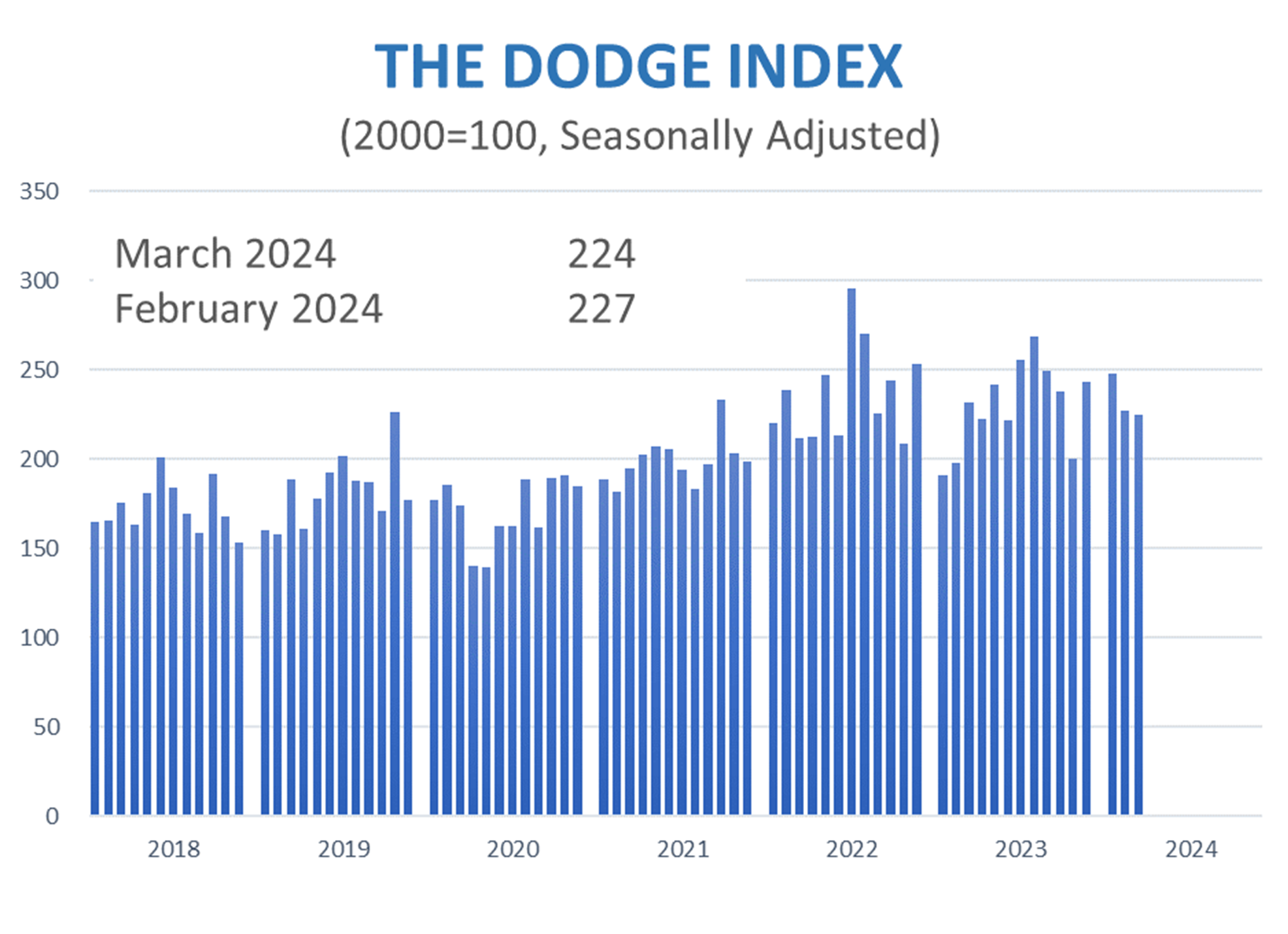

Gains in single family and infrastructure starts were not enough to offset nonresidential building weakness

BEDFORD, MA —April 23, 2024 — Total construction starts fell 1% in March to a seasonally adjusted annual rate of $1.06 trillion, according to Dodge Construction Network. Nonresidential building starts fell 9%, while nonbuilding starts improved by 7%, and residential starts moved 1% higher. On a year-to-date basis through March total construction starts were up 13% from the first three months of 2023. Residential starts were up 24%, while nonbuilding starts gained 16% and nonresidential building starts rose 2%.

For the 12 months ending March 2024, total construction starts were up 1% from the 12 months ending March 2023. Nonresidential building starts were down 8% while residential starts were flat, and nonbuilding starts were up 18% on a 12-month rolling sum basis.

“The construction sector has hit a soft patch to start 2024,” said Richard Branch, chief economist for Dodge Construction Network. “However, this should not be overly surprising given high rates and restrictive credit. There are bright spots though as single family starts are moving higher and federal dollars are lifting nonbuilding starts. The recent hot inflation readings likely mean that rate cuts won’t happen until later in the year, and as a result, the commercial and multifamily sectors will continue to languish.”

Nonbuilding

Nonbuilding construction starts gained 7% in March to a seasonally adjusted annual rate of $298 billion. Utility/gas starts more than doubled during the month, while highway and bridge starts moved 19% higher. Environmental public works starts fell 24% in March and miscellaneous nonbuilding starts lost 42%. On a year-to-date basis through March total nonbuilding starts were 16% higher. Miscellaneous nonbuilding starts were up 26%, environmental public works improved 18%, highway and bridge starts rose 15%, and utility/gas plants were 6% higher on a year-to-date basis through March.

For the 12 months ending March 2024, total nonbuilding starts were 18% higher than the 12 months ending March 2023. Utility/gas starts were up 38%, miscellaneous nonbuilding starts rose 18%, highway and bridge starts rose 12%, and environmental public works starts moved 9% higher for the 12 months ending March 2024.

The largest nonbuilding projects to break ground in March were the $1 billion Eland Solar and Battery Storage facility in Mojave, California, the $908 million SR826 road and bridge project in Miami, Florida, and the $650 million Serrano Solar and Storage project in Pima and Pinal counties in Arizona.

Nonresidential

Nonresidential building starts fell 9% in March to a seasonally adjusted annual rate of $363 billion. Manufacturing starts were down 58%, while commercial starts fell 1% due to a pullback in office and hotel starts. Institutional starts gained 4% in March, which was largely the result of some very large healthcare projects getting underway. On a year-to-date basis through March, total nonresidential starts were up 2%. Institutional starts were 12% higher, while commercial starts were flat, and manufacturing starts lost 15% on a year-to-date basis through March.

For the 12 months ending March 2024, nonresidential building starts were 8% lower than the previous 12 months. Manufacturing starts were down 30% and commercial starts were down 10%, while institutional starts were 7% higher for the 12 months ending March 2024.

The largest nonresidential building projects to break ground in March were the $1.3 billion Rady Children’s Hospital Intensive Care Unit in San Diego, California, the $600 million Google data center in The Dalles, Oregon, and a $532 million Federal prison in Leavenworth, Kansas.

Residential

Residential building starts moved 1% higher in March to a seasonally adjusted annual rate of $400 billion. Single family starts improved 9% while multifamily starts lost 14%. On a year-to-date basis through three months, total residential starts were 24% higher. Single family starts improved 34% and multifamily starts were 9% higher on a year-to-date basis.

For the 12 months ending March 2024, residential starts were unchanged from the previous 12 months. Single family starts were 4% higher, while multifamily starts were 7% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in March were the $385 million One Naples Ritz Carlton residences in Naples, Florida, the $261 million 100 North Main mixed-use project in Memphis, Tennessee, and the $190 million The August at Steelpointe Harbor project in Bridgeport, Connecticut.

Regionally, total construction starts in March rose in the South Central and West regions, but fell elsewhere.

The post Construction Starts lose 1% in March appeared first on Dodge Construction Network.

Source: New feed

ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

The U.S. Chamber of Commerce plans a legal challenge to the rule; a construction group is weighing a similar action.

Source: New feed

The U.S. Interior Dept. also added a sector push in announcing a schedule to lease up to 12

new U.S. offshore wind project sites through 2028.

Source: New feed

Report cites continued inflation, as well as “supply chain issues and other economic challenges” as reasons for the downward trend.

Source: New feed

The U.S. Interior Dept. also added a sector push in announcing a schedule to lease up to 12

new U.S. offshore wind project development sites through 2028.

Source: New feed

Autodesk and Nemetschek Group have agreed to make their AEC and media-related products more interoperable via open application program interfaces.

Source: New feed