Most of the money will go toward the costs of the ongoing cleanup following the derailment in last year East Palestine.

Source: New feed

Most of the money will go toward the costs of the ongoing cleanup following the derailment in last year East Palestine.

Source: New feed

Project cost squeeze, bad blood aired in contractor’s court filings as it seeks Chapter 11 protection following a “structured exit” from the estimated $10B Golden Pass LNG export terminal.

Source: New feed

The steel frame of a manufacturing plant failed, injuring three workers.

Source: New feed

ENR’s 20-city average cost indexes, wages and materials prices. Historical data and details for ENR’s 20 cities can be found at ENR.com/economics

Source: New feed

Steel, concrete interests claim proposed legislation disrupts the competitive process and could strain industry supply chain.

Source: New feed

Opponents say bill puts other materials at a disadvantage.

Source: New feed

Phishing fraud targeting construction firms is resulting in a growing number of financial losses.

Source: New feed

Phishing fraud targeting construction firms is resulting in a growing number of financial losses.

Source: New feed

U.S. Supreme Court decisions are reshaping DEI initiatives and public works contracting.

Source: New feed

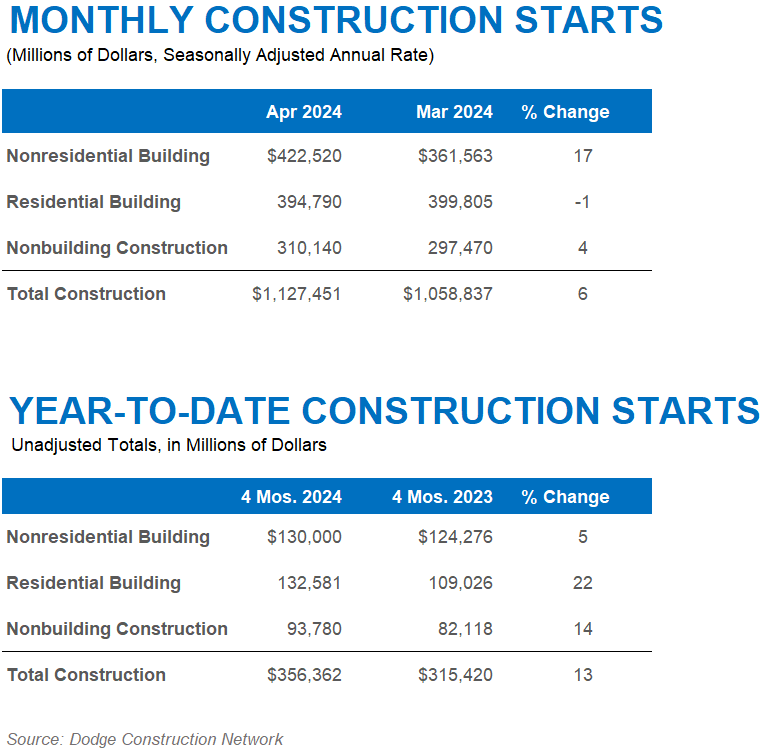

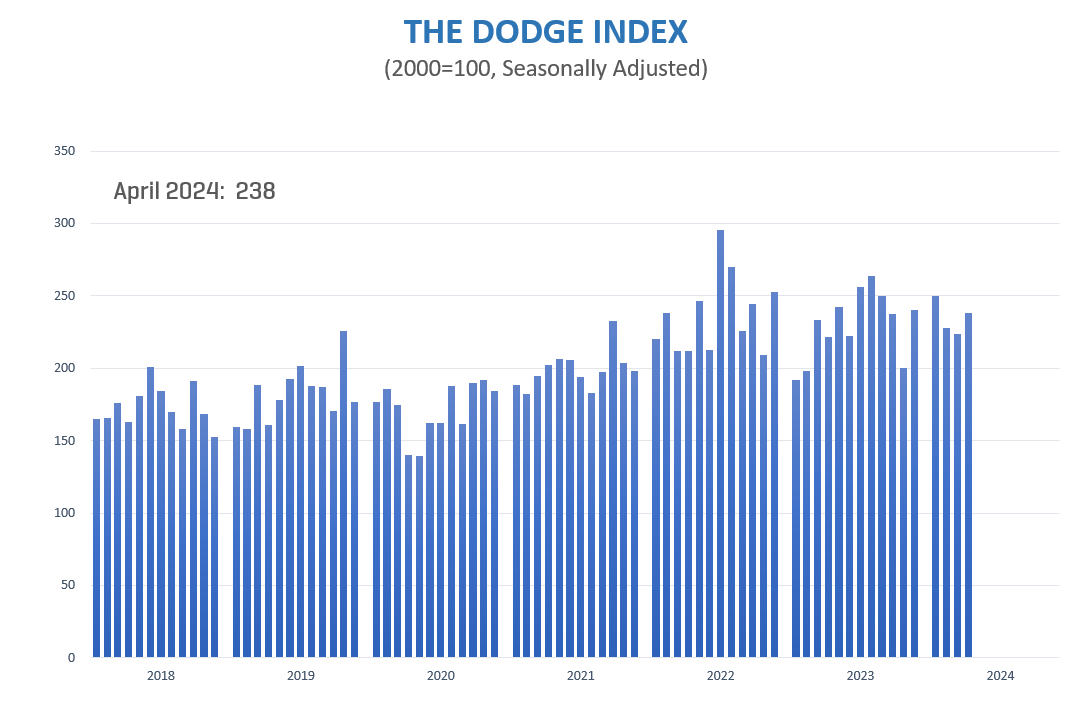

April’s increase reverses two months of decline

BEDFORD, MA —May 16, 2024 — Total construction starts rose 6% in April to a seasonally adjusted annual rate of $1.13 trillion, according to Dodge Construction Network. Nonresidential building starts gained 17%, nonbuilding starts were 4% higher, while residential starts slipped 1%. On a year-to-date basis through April total construction starts were up 13% from the first four months of 2023. Residential starts were up 22%, while nonbuilding starts gained 14% and nonresidential building starts rose 5%.

For the 12 months ending April 2024, total construction starts were up 2% from the 12 months ending April 2023. Nonresidential building starts were down 8% while residential starts were up 3%, and nonbuilding starts were up 16% on a 12-month rolling sum basis.

“The rebound in starts in April was certainly good news for the sector,” said Richard Branch, chief economist of Dodge Construction Network. “While the uncertain timing of Fed interest rates cuts is causing concern, developers and owners are feeling reasonably confident that end-market demand will sustain project starts in some sectors. While risk remains in the sector for interest rates, labor, and material prices the value of projects in planning has been reasonably stable indicating future confidence.”

Nonbuilding

Nonbuilding construction starts gained 4% in April to a seasonally adjusted annual rate of $310 billion. Environmental public works starts rose 31% in the month, while miscellaneous nonbuilding rose 20%, and highway and bridge starts gained 8%; utility/gas starts shed 34% in April following a large gain in March. On a year-to-date basis through April total nonbuilding starts were 14% higher. Miscellaneous nonbuilding starts were up 28%, environmental public works improved 24%, highway and bridge starts rose 16%, and utility/gas plants were 10% lower on a year-to-date basis through April.

For the 12 months ending April 2024, total nonbuilding starts were 16% higher than the 12 months ending April 2023. Utility/gas starts were up 26%, miscellaneous nonbuilding starts rose 19%, environmental public works starts moved 14% higher, and highway and bridge starts rose 11% for the 12 months ending April 2024.

The largest nonbuilding projects to break ground in April were the $834 million I-405 Brickyard Improvement project in Bothell, Washington, the $533 million Flat Ridge wind farm in Harper and Kingman counties in Kansas, and a $490 million resurfacing project in Lanai City, Hawaii.

Nonresidential

Nonresidential building starts rose 17% in April to a seasonally adjusted annual rate of $423 billion. Manufacturing starts more than doubled during the month due to the start of two large projects. Institutional starts rose 16% due to a gain in healthcare and transportation projects, while commercial starts lost 1% due to a pullback in parking and warehouse projects. On a year-to-date basis through April, total nonresidential starts were up 5%. Institutional starts were 19% higher, while commercial and manufacturing starts were each down 6% on a year-to-date basis through April.

For the 12 months ending April 2024, nonresidential building starts were 8% lower than the previous 12 months. Manufacturing starts were down 31% and commercial starts were down 13%, while institutional starts were 9% higher for the 12 months ending April 2024.

The largest nonresidential building projects to break ground in April were the $3.7 billion UC Davis Medical Center in Sacramento, California, the $1.8 billion Linde Blue Hydrogen plant in Beaumont, Texas, and the $1 billion Scout Motors EV plant in Blythewood, South Carolina.

Residential

Residential building starts moved 1% lower in April to a seasonally adjusted annual rate of $395 billion. Single family starts fell 7%, while multifamily starts gained 13%. On a year-to-date basis through four months, total residential starts were 22% higher. Single family starts improved 32% and multifamily starts were 4% higher on a year-to-date basis.

For the 12 months ending April 2024, residential starts were 3% higher from the previous 12 months. Single family starts were 10% higher, while multifamily starts were 7% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in April were the $300 million 1690 Revere Beach Parkway in Everett, Massachusetts, the $270 million Innovative Urban mixed-use building in East New York, NY, and the $160 million 120 E144th Street apartment building in Mott Haven, New York.

Regionally, total construction starts in April rose in all five regions.

The post Construction Starts gain 6% in April appeared first on Dodge Construction Network.

Source: New feed