NY State Thruway Authority is suing the Fluor-led bridge construction consortium for at least $6 million.

Source: New feed

NY State Thruway Authority is suing the Fluor-led bridge construction consortium for at least $6 million.

Source: New feed

Defendants include a contractor now at work to replace a deteriorated section of the 56-year-old Providence span carrying I-195 that has been shut since December

Source: New feed

With the compounding effects of more frequent and intense storms, infrastructure investments—despite recent historic levels in infrastructure funding—must take into account where they’ll get the most bang for the buck.

Source: New feed

Revised jobs report cuts the previous number by 0.5%, or 818,000 jobs, but one expert says it won’t have much effect on unemployment rate data or future policymaking.

Source: New feed

The new jobs reports cuts the previous number by 0.5%, or 818,000 jobs, but experts say this won’t have much effect on the future.

Source: New feed

PCL Construction secures a $42-million progressive design-build contract to expand San Diego’s South Bay International Wastewater Treatment plant, the first contract in an overall $600 million project to treat wastewater flows that have been crossing the border with Mexico since 2022.

Source: New feed

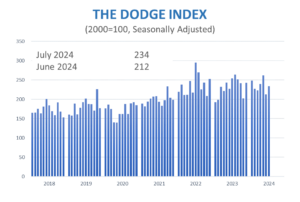

A sharp rebound occurred in nonresidential building and infrastructure starts, offsetting residential pullback

BEDFORD, MA —August 22, 2024 — Total construction starts moved 10% higher in July to a seasonally adjusted annual rate of $1.1 trillion, according to Dodge Construction Network. Nonresidential buildings and infrastructure starts performed strongly during the month, countering a decline in residential starts. During the month, nonresidential buildings rose 25% and infrastructure starts increased by 19%. Residential starts fell 8% during the month. On a year-to-date basis through July, total construction starts were up 6% from the first seven months of 2023. Residential starts were up 11%, nonresidential buildings rose 5%, and nonbuilding starts were flat.

For the 12 months ending July 2024, total construction starts were up 3% from the 12 months ending July 2023. Nonresidential building starts were down 1%, residential starts were up 7%, and nonbuilding starts were up 5% on a 12-month rolling sum basis.

“Construction starts showed great promise in July,” said Richard Branch, chief economist of Dodge Construction Network. “However, the short-term remains questionable due to high interest rates. The Federal Reserve is likely to cut interest rates in September, which will, over time, make market conditions more conducive to moving projects forward. In the meantime, construction starts will likely remain volatile over the next few months.”

Nonbuilding

Nonbuilding construction starts rose 19% from June to July to a seasonally adjusted annual rate of $298 billion. All sectors increased during the month, with utility/gas starts rebounding from a weak June and more than doubling in July. Highway and bridge starts rose 11%, environmental public works gained 8%, and miscellaneous nonbuilding starts were 1% higher. On a year-to-date basis through July total nonbuilding starts were flat from a year ago. Environmental public works starts were 12% higher, miscellaneous nonbuilding starts rose 5%, highway and bridge starts were 3% higher, but utility/gas starts were down 16% through July.

For the 12 months ending July 2024, total nonbuilding starts were 5% higher than the 12 months ending July 2023. Utility/gas starts were up 10%, environmental public works starts improved 6%, while highway and bridge starts and miscellaneous nonbuilding starts were each 2% higher for the 12 months ending July 2024.

The largest nonbuilding projects to break ground in July were the $1.5 billion Revolution Wind offshore wind farm off the coast of Rhode Island, the $819 million Potomac River Tunnel in Washington, DC, and the $800 million Ryan Field Stadium at Northwestern University in Evanston, Illinois.

Nonresidential

Nonresidential building starts improved 25% in July to a seasonally adjusted annual rate of $445 billion. Manufacturing starts improved 33%, while commercial starts rose 30% due to increases in data center and hotel starts. Institutional starts gained 18% in July mostly due to a sharp increase in healthcare starts. On a year-to-date basis through July, total nonresidential starts were up 5%. Institutional starts were 13% higher, while commercial starts were up 3%, and manufacturing starts were 12% lower on a year-to-date basis through July.

For the 12 months ending July 2024, nonresidential building starts were 1% lower than the previous 12 months. Manufacturing starts were down 19% and commercial starts were down 5%, while institutional starts were 10% higher for the 12 months ending July 2024.

The largest nonresidential building projects to break ground in July were the $2.1 billion Novo Nordisk plant in Clayton, North Carolina, the $1.6 billion first phase of the AWS Amazon data center in Canton, Mississippi, and the $800 million Meta data center in Montgomery, Alabama.

Residential

Residential building starts lost 8% in July, falling to a seasonally adjusted annual rate of $365 billion. Single family starts shed 13% in the month, while multifamily starts rose 3%. On a year-to-date basis through seven months, total residential starts were 11% higher. Single family starts improved 22% and multifamily starts were 8% lower on a year-to-date basis.

For the 12 months ending July 2024, residential starts were 7% higher than the previous 12 months. Single family starts were 17% higher, while multifamily starts were 9% lower on a 12-month rolling sum basis.

The largest multifamily structures to break ground in July were the $300 million Music Row Albion apartment towers in Nashville, Tennessee, the $254 million Commodore Perry apartments in Buffalo, New York, and the $250 million One Tampa condominiums in Tampa, Florida.

Regionally, total construction starts in July rose in all regions.

The post Construction Starts Jump 10% in July appeared first on Dodge Construction Network.

Source: New feed

The U.S. Chamber of Commerce and Associated Builders and Contractors challenged the agreement ban, but it was supported by building trades unions.

Source: New feed

The ban had been challenged by the U.S. Chamber of Commerce as well as the Associated Builders and Contractors, which hailed the judge’s decision as a victory.

Source: New feed

SR 400 Peach Partners will operate and maintain the lanes for 50 years.

Source: New feed